In the October 1 vice-presidential debate, Senator JD Vance (R‑OH) said, “Look, in Springfield, Ohio and in communities all across this country … you have got housing that is totally unaffordable because we brought in millions of illegal immigrants to compete with Americans for scarce homes.” (Emphasis added.) Vance is correct in saying that immigrants increase the price of houses.

The intersection of supply and demand determines housing prices, like all prices. When housing supply curves are upward-sloping, increased demand from immigrants will increase housing prices. Immigrants are people who want roofs over their heads, after all. Housing supply is relatively inelastic in many places, partly because of government policies like zoning and height restrictions and urban growth boundaries. Land use liberalization could make the housing supply more elastic, but the housing supply will not become perfectly elastic even if all land use laws are abolished. That means that higher demand, all things equal, will drive up prices and the quantity of housing.

Immigrants also induce a housing supply effect because 10 percent of all foreign-born workers labor in the construction industry, which rises to 14.9 percent for noncitizens, according to the 2023 American Community Survey. Only 6.2 percent of native-born Americans work in construction. Estimates show that about 30 percent of all construction workers are immigrants, with higher rates in California, Texas, Florida, New York, New Jersey, and Nevada. Deporting those workers or halting more immigrants will reduce the growth in the housing supply.

However, all immigrants demand housing. Even immigrants who work in construction increase housing demand first before they can construct more housing. That increase in demand drives up prices and incentivizes new supply through further construction, renovation, or increasing the supply of rental units through other means. However, the marginal immigrant increases housing demand more than he increases housing supply.

There is much empirical work to support this theory. My first stop on this journey is Albert Saiz’s 2007 Journal of Urban Economics paper, “Immigration and Housing Rents in American Cities.” The paper’s abstract merits quoting in full:

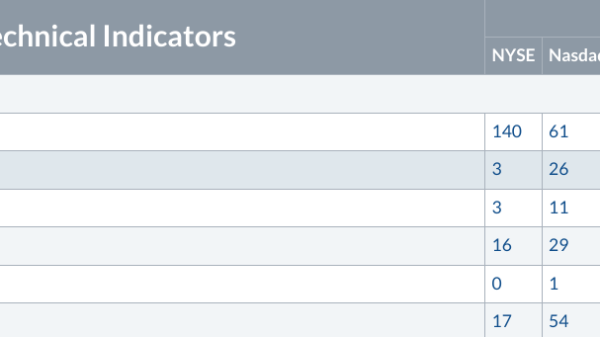

Is there a local economic impact of immigration? Immigration pushes up rents and housing values in US destination cities. The positive association of rent growth and immigrant inflows is pervasive in time series for all metropolitan areas. I use instrumental variables based on a ‘shift-share’ of national levels of immigration into metropolitan areas. An immigration inflow equal to 1% of a city’s population is associated with increases in average rents and housing values of about 1%. The results suggest an economic impact that is an order of magnitude bigger than that found in labor markets.

Saiz’s last sentence is especially worth noting because most of the debate over the economics of immigration is focused on wages, which are barely affected by immigration. In presentations to students, I often say that housing is the market where prices are most affected by immigration. Relative to the labor market, the marginal immigrant affects housing prices by a factor of 3 to 10 more than wages, depending on your preferred wage elasticity. Other papers find directionally similar effects.

Jacob Vigdor found that an additional immigrant in a county increased the price of the median house by about 12 cents ($0.116) in 2010. More than two-thirds of native-born Americans own their own homes, and about two-thirds of all houses in the United States are owned by native-born Americans, most of whom are middle class. Thus, most of the increase in housing wealth caused by immigration accrues to native-born Americans, if we take Vigdor’s research seriously. (Disclosure: Vigdor is working on updating these figures for Cato. I’ll report back if the effect still holds).

According to Vigdor’s research, over 90 percent of housing prices comes from other economic factors and immigration has become less important since 2015. Vigdor also notes that a significant part of the increase in housing prices occurs in areas where housing prices likely would have fallen in the absence of immigration, like in Springfield.

Decreased immigration also reduces residential housing construction, which puts upward pressure on housing prices. Justin Wolfers tweeted this recent working paper that uses an exogenous immigration enforcement shock that was rolled out in a staggered way across US jurisdictions that decreased the supply of construction workers that then, in turn, reduced residential homebuilding and raised the quality-adjusted price of housing. That’s all well and good. Secure Communities, the immigration enforcement program used as the exogenous staggered shock, was almost surely not randomly rolled out across US jurisdictions (see Figure 2 in the paper). But that probably doesn’t matter for the purposes of this paper. As mentioned above, immigrants also make up a disproportionate share of construction workers.

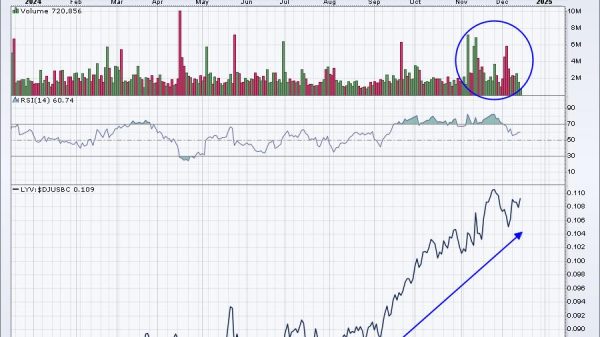

Bringing the discussion back to Springfield, Ohio, where Vance started, housing prices have increased there as more Haitian migrants have moved in. According to Redfin, the median sale price of a single-family home sold there increased from $78,500 in August 2019 to $158,000 in August 2024, a 101 percent increase in nominal terms. The nationwide increase was 46 percent in nominal terms during the same period. That has made renters and first-time home buyers worse off in Springfield and homeowners, who are mostly native-born, better off.

One can slice and dice the increase in housing prices in multiple ways. Houses are bigger than they used to be but the real price per square foot is up nationwide. However, the price per square foot as a share of income is flat. The first measure is the best for evaluating Vance’s claim in the debate and it supports his point.

Is this a problem? And what does it mean for policy?

The government should not seek to increase, reduce, or stabilize housing prices in the United States. It should merely respect property rights for land use and get out of the way to allow housing supply and housing demand to equilibrate to prices that change as the world does.

“Getting out of the way” would require state and local governments to eliminate zoning and land use policies and for the federal government to leave the mortgage business, among other changes that I support. The government should liberalize immigration, and market prices should adjust. However, it is safe to say that immigrants increase housing prices in the United States.

There’s much to disagree with in Vance’s statements about immigration—their economic effects on the United States, the desirability of his policy suggestions, and his inaccurate descriptions of current policy in his quote at the beginning of this piece. I’ll yield to no one in my defense of the huge net benefits of immigration for Americans, immigrants, and foreigners overseas.

However, we must be honest and intellectually rigorous when writing about the effect of immigration in the United States. Vance is correct that immigrants drive up housing prices. You can decide whether that’s good or bad, but you should accept it as true.