This month Cato is hosting a Congressional Fellowship on tax and trade ahead of a year that promises to be busy for both policy areas. The fellowship is a nine-week program attended by a bi-partisan cohort of congressional staff that engage in weekly discussion sessions with featured speakers. The first four discussions are dedicated to tax policy. We will cover tax code basics, the Tax Cuts and Jobs Act (TCJA), radical tax reforms, and international tax. After each week’s session, I will provide an embellished class outline for those who want to follow along. This is the first in a four-part series.

The first session starts with an overview of US federal revenue sources and the distribution of who pays taxes. We then cover some differences between income and consumption tax bases, tax expenditures, and the deadweight loss caused by high tax rates. This class was co-taught with Cato’s Chirs Edwards.

Sources of Revenue

Americans paid roughly $7.2 trillion in taxes across all levels of government (federal, state, local) in 2023. The federal government collected two-thirds of that revenue, or about $4.7 trillion.

About half of federal revenue comes from the individual income tax (Figure 1). The income tax includes revenues from taxes on wages, capital gains and dividends, and pass-through businesses. The United States is relatively unique in that a majority of business profits are “passed through” to individual tax returns and taxed as personal income.

The income tax system is structured with brackets that apply progressively higher tax rates to different income ranges. Rates start at 10 percent for the lowest incomes and increase incrementally to 37 percent for the highest incomes, with each rate applying only to income within its specific income bracket.

Payroll taxes make up 36 percent of federal revenue. They consist of a flat 12.4 percent tax on wages up to $176,100 (in 2025) that partially funds Social Security and a 2.9 percent tax (with no wage cap) that funds about a third of Medicare. The combined rate is 15.3 percent, split evenly between the employer and the employee, although economists generally agree workers pay the full economic cost of the tax. Individuals with wages above $200,000 pay an additional 0.9 percent Medicare tax.

The corporate income tax raises about 9 percent of federal revenue. Other sources of revenue (customs duties, estate tax, excise taxes, and federal reserve earnings) round out the last 5 percent.

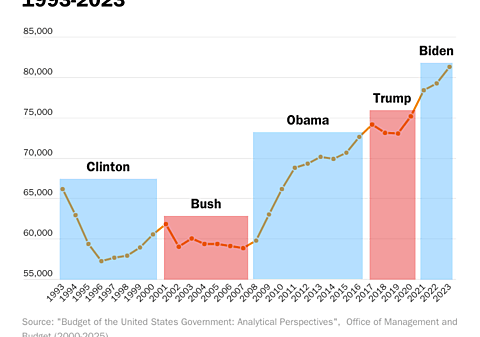

Figure 2 shows revenue sources as a share of GDP since 1950. Total revenue as a share of the economy has remained relatively stable over this period, fluctuating around 17 percent. Individual income taxes were the largest source of revenue during this time, and their stability is particularly impressive given that top income tax rates were 91 percent in the 1950s, 70 percent in the 1970s, and eventually fell to 28 percent in 1986. The rate increased again in the early 1990s, rising to 39.6 percent in 1993. The top rate was cut to 37 percent in 2018. See a complete history of the top and bottom income tax rates here.

Payroll tax revenue increased as rates slowly ratcheted up from 2 percent in 1937, when Social Security was created, to 15.3 percent in 1990 (adding in Medicare taxes in 1966). The wage base also expanded from its initial $66,000 (in today’s dollars). More on the evolution of the payroll tax rate here and tax base here.

Corporate income tax revenue decreased in importance through the 1980s as more businesses shifted into the passthrough form. The statutory tax rate was cut from 52 percent in the 1950s to 35 percent in 1993 before being cut to 21 percent in 2018.

Tax Distribution

Data on income tax payments and estimates from the Treasury Department show that the US federal tax system is highly progressive, or graduated, meaning that higher-income Americans pay a significantly larger share of their incomes in taxes than others.

Figure 3 reports the latest Internal Revenue Service data on income taxes for the 2022 tax year. As a share of adjusted gross income (AGI), the top 1 percent earned 22 percent of total income and paid 40 percent of all the income taxes. The top 10 percent earned 50 percent of the income and paid 72 percent of the income tax. The lowest-income half of taxpayers earned just shy of 12 percent of AGI and paid 3 percent of income taxes.

The US Treasury’s Office of Tax Analysis estimates average federal tax rates, accounting for income, payroll, corporate, and other taxes. Figure 4 shows that tax rates climb as incomes rise.

The lowest-income 20 percent of earners, measured by adjusted family cash income, face average tax rates that are either negative or close to zero. A negative tax rate means the taxpayer is a net beneficiary of the tax system, likely receiving refundable tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and federal health care exchange subsidies.

On the other end of the distribution, the top 10 percent of income earners pay an average tax rate of 27 percent. Treasury breaks the highest income earners into narrower segments, showing that the highest-earning 0.1 percent pay the highest estimated average tax rate of 33.5 percent.

Other recent Treasury data show that the wealthiest 92 taxpayers in the US paid an average effective tax rate of 60 percent (state, federal, international).

The Tax Base: Consumption vs. Income Taxes

Every tax has two fundamental components: the tax base—what is subject to tax—and the tax rate. Defining the tax base is the most economically consequential decision in a tax system, and the correct tax base—consumption or income—is the subject of a fundamental disagreement between policymakers with different goals.

Conceptually, a person can get their money from three sources: returns to labor (wages), returns to capital (dividends, interest, small business profits), and changes in wealth (capital gains).

The dominant conception of the ideal tax base by liberal economists is Haig-Simons income, named after economists Robert Haig and Henry Simons. This broad conception of the tax base includes all three sources of income. It is defined as consumption plus the change in net wealth taxed each year, including unrealized gains. In theory, it would tax the value of your financial assets, house, and consumer durables yearly as their value rises. It would also tax the imputed (fictitious) return from personally owned durable goods like houses, cars, and even blue jeans.

The theoretical Haig-Simons tax base is very impractical. So, Congress has imposed an actual income tax, which taxes capital gains when they are realized and ignores imputed income on personally owned durable goods. However, the extremely broad tax base under Haig-Simons theory continues to drive federal tax policy. For example, President Joe Biden and Democratic presidential candidate Kamala Harris proposed taxing unrealized gains for wealthy individuals.

Another way to think about the tax base is how a person uses their money (instead of how they earned it). Earnings can be spent on consumption, or earnings can be saved and invested. Money saved is future consumption. Taxing consumption is often done through a sales tax or a value-added tax (VAT), but it can also be done through an income tax, with a deduction for saving (called a consumed income tax).

Income taxes tend to levy higher effective tax rates on savers than on people who consume their income immediately by taxing wages and also the returns on wages saved and invested. Former Princeton professor David Bradford was a crucial voice on the advantages of consumption taxes over income taxes. Alan Viard concisely summarizes how taxes on capital income penalize saving here.

In the US, conservative and libertarian economists and tax scholars favor tax changes that move the tax system toward a consumption tax base. Consumption tax bases are more economic growth-oriented because they remove the income tax’s bias against investment, which is one of the foundations of long-term growth. Consumption taxes are also better at equalizing marginal tax rates across industries and can account more fully for the distortions of inflation. They also tend to be simpler systems without complicated depreciation rules or special systems for capital gains.

Liberal and progressive economists and tax scholars often favor a version of the income tax. They tend to discount the taxes’ negative impact on growth and have a strong bias for high levels of redistribution through disproportionate taxes on the income sources of the wealthiest Americans, who rely more on investment income. Although consumption taxes can be designed with progressive rate structures, income taxes can more easily levy confiscatory taxes on the most visible forms of investment income.

Tax Expenditures

Due to this tension between the desire for growth and redistribution, the modern US income tax is a hybrid system, stuck in a tug-of-war between consumption and income taxes. Federal tax loopholes, credits, and deductions—called tax expenditures—are measured from a modified Haig-Simons income tax base.

Using the liberal’s preferred definition of the ideal tax base creates a biased list of officially tallied tax expenditures. The Joint Committee on Taxation and the Department of the Treasury compile tax expenditure lists. About half of the dollar value of the official tax expenditures would not be considered as such if measured from a consumption tax baseline. Operating from a misleading list, lawmakers’ well-meaning quest to broaden the tax base often mixes up true loopholes in the tax code, and economically beneficial provisions that alleviate biases against saving and investment.

The table below from Chris Edward’s Cato Policy Analysis “Tax Expenditures and Tax Reform” separates the true tax loopholes and those that would not be included on a list of tax expenditures under a consumption tax base. Read the full study for an in-depth discussion of the consumption and income tax bases.

The Tax Rate: Deadweight Loss

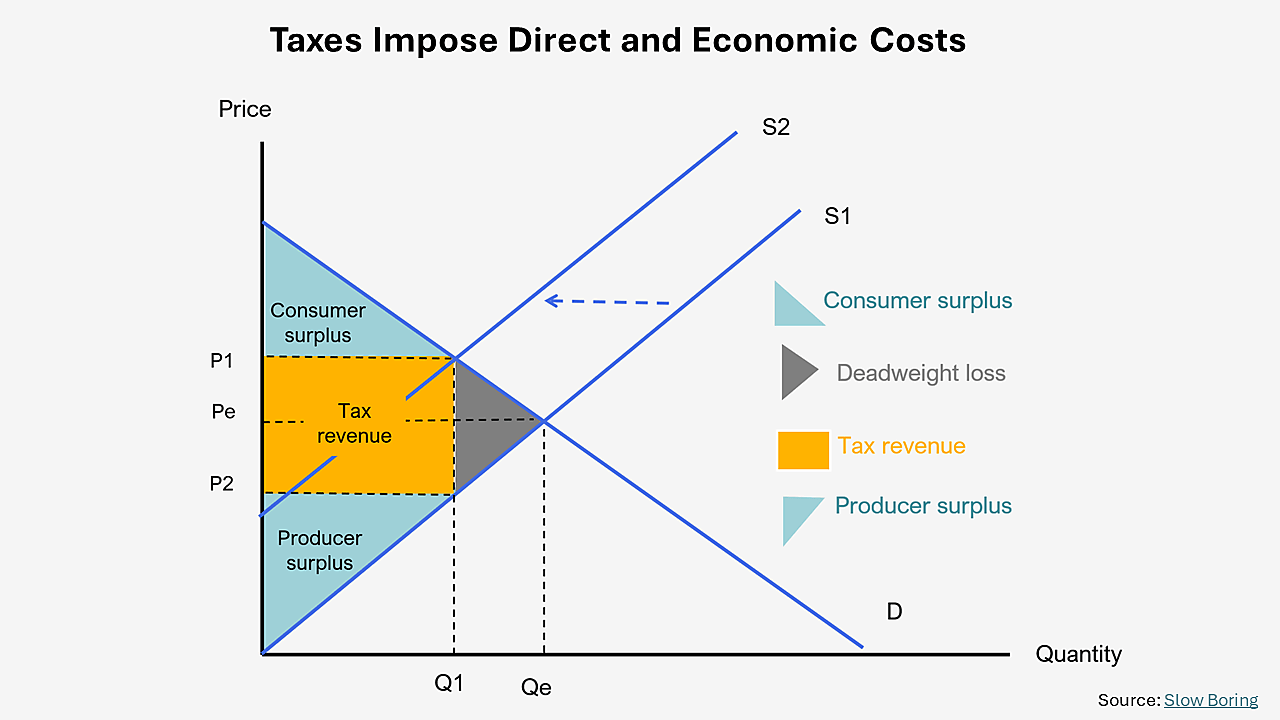

The economic harm caused by a tax levied on a given tax base is a function of the tax rate. Lower tax rates change people’s behavior less, and higher tax rates change their behavior more, resulting in higher economic costs. A tax’s primary effect is transferring private resources to the government; however, this transfer also causes a deadweight loss (or excess burden).

When the government imposes a tax, it raises the price of the taxed good or activity, inducing less of it. The recently implemented congestion price in New York City is a clear example: the new tax is intended to raise the price of driving into the city, causing some people to forego the trip (those who value the trip less than the new higher cost will forgo the trip). In the case of congestion pricing, the decreased activity is a desired feature of the tax. Other taxes on income, business profits, or investment returns similarly result in people working less, fewer businesses, and lower levels of investment.

In the classic supply and demand framework, the deadweight loss triangle graphically illustrates the value of market trades that are not made because of the tax-induced higher price. The area of the deadweight loss triangle and, thus, the economic loss caused by the tax rises exponentially with the tax rate. For example, if a tax rate is doubled, the deadweight loss caused by the tax quadruples, resulting in the lost economic activity increasing faster than the additional revenue. (Figure adapted from Slow Boring.)

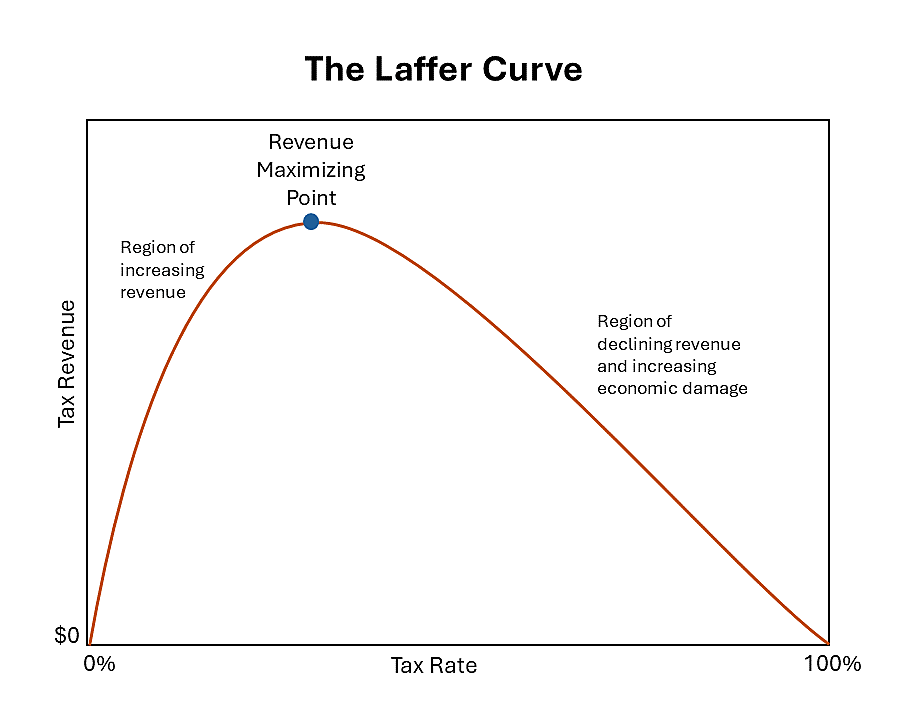

This relationship between the tax rate, revenue, and economic activity underlies the well-known Laffer Curve. The hypothesis states that an income tax will not raise any revenue when the rate is zero or when the rate is 100 percent. There is some point in the middle where government revenue is maximized. Revenue generally rises with the rate until the deadweight loss of the tax is so large—by shrinking the tax base—that revenue begins to fall.

The shape of the Laffer Curve is determined by the tax base (what is subject to tax) and people’s responsiveness to the tax. When the tax base has many loopholes and carveouts, the top of the curve will be at a lower tax rate as taxpayers have more opportunities to invest in avoidance and evasion.

Lastly, the top of the Laffer Curve does not tell policymakers what the tax rate should be; it simply provides an extreme upper bound on tax rates that, if raised any higher, would be net losers for both the government and taxpayers. For taxpayers and the economy, policymakers should aim not for the revenue-maximizing rate but the rate that maximizes overall prosperity.

Next week, we will apply these principles to the 2017 tax reforms.