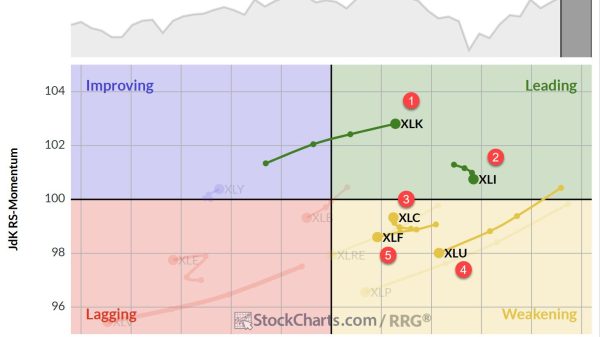

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market. He starts at the asset allocation level using Relative Rotation Graphs (RRGs) to analyze stocks vs bonds performance, then highlights the ongoing defensive sector rotation, and identifies strength in large-cap value stocks.

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market. He starts at the asset allocation level using Relative Rotation Graphs (RRGs) to analyze stocks vs bonds performance, then highlights the ongoing defensive sector rotation, and identifies strength in large-cap value stocks.

To close out the show, Julius dives into stock-specific opportunities based on the relative rotation of sector constituents, pointing to potential leadership shifts as market volatility rises.

This video was originally published on April 17, 2025. Click on the icon above to view on our dedicated page for Julius.

Past videos from Julius can be found here.

#StayAlert, -Julius