The stock market closed on a down note on Monday. It’s just one day before the general election and, as you know from experience, elections tend to be like an adrenaline shot to the market, the effects of which can last from days to months.

Positioning Yourself for Post-Election Market Stress

Several analysts have hinted that Wall Street may have already priced in a Trump win. If that outcome materializes, and depending on the outcome of the Senate and House races, the markets may readjust, depending on how it forecasts changes in policy and its effect on the economy.

At this stage of the game, with a market poised for adjustments and overreactions, it might work in your favor to get a big-picture view of how sectors will respond in the coming days, and which stocks within those sectors may be gaining strength as the political fog clears.

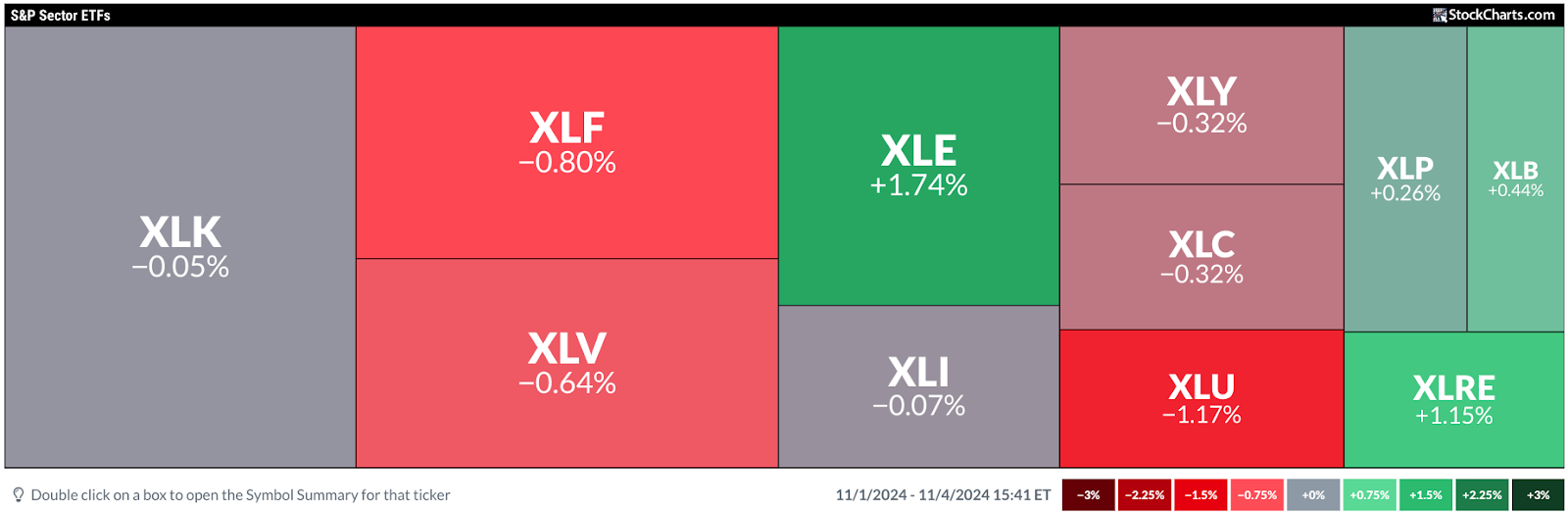

Scanning the Market in a Rapidly Shifting Environment

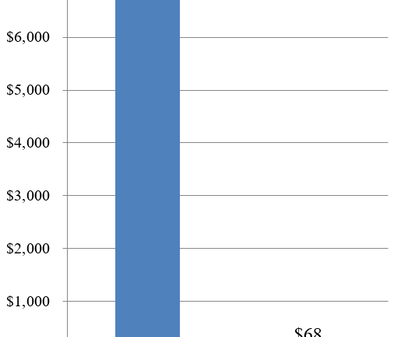

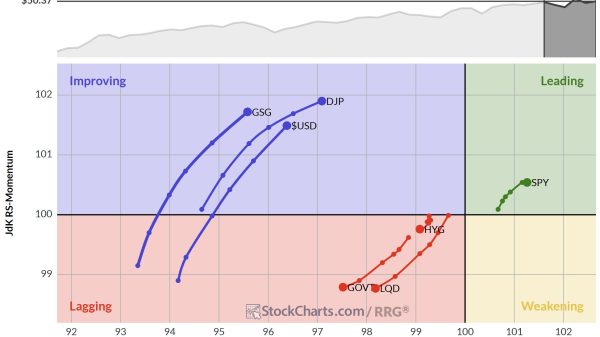

After Monday’s market close, Energy and Real Estate emerged as the top performers, while Utilities and Financials lagged. To quickly scan this outcome, from your StockCharts Dashboard click the arrow next to the Charts & Tools tab and select MarketCarpets. From the Select Group dropdown menu, choose S&P Sector ETFs.

FIGURE 1. MARKETCARPETS CHART OF SECTOR ETFS ON NOVEMBER 4. The Energy sector was the top performer while Utilities was the weakest performer.Image source: StockCharts.com. For educational purposes.

The top-performing sectors were Energy, up 1.74%, and Real Estate, up 1.15%. Energy stocks got a boost after OPEC+ hit pause on planned oil production increases. Meanwhile, real estate stocks rallied thanks to big acquisition moves and some pre-election bets on policy changes that could favor property.

The big losing sectors were Utilities, down 1.17%, and Financials, sliding 0.80%. Utilities dropped as regulatory concerns emerged after FERC blocked a capacity increase for an Amazon-linked nuclear plant. Financials slid amid pre-election uncertainty, with investors wary of potential policy shifts affecting major institutions within the industry.

Let’s zoom in on the Energy sector to see which industries and stocks are outperforming.

FIGURE 2. MARKETCARPETS CHART FOR THE ENERGY SECTOR. Most industries within the sector are bullishly green.Image source: StockCharts.com. For educational purposes.

The size of the squares is weighted by market cap, and the largest and most recognizable outperformer on this list, Exxon (XOM), is up 3.18%. However, the leading performers aren’t all well-known names; you can see these top stocks listed in the table to the right of MarketCarpets among the day’s top 10.

Real Estate is another sector that’s been quietly creeping up. While the stocks comprising it haven’t been making headline news, investors have made their moves in the sector.

FIGURE 3. MARKETCARPETS CHART FOR REAL ESTATE SECTOR. Lots of green, but not many well-known stocks.Image source: StockCharts.com. For educational purposes.

Fangdd Network Group Ltd (DUO) had the largest jump, up 9.09%, but beware—it’s virtually a penny stock despite its high trading volume and market cap, all of which can be seen in its Symbol Summary.

Public Storage (PSA) had a sizable jump, up 2.71%, while Simon Property (SPG) also had a comparable gain of 2.64%. Again, these aren’t necessarily stocks to invest in, but they are large stocks that help paint a picture of what’s driving the sector. It’s up to you to dig deeper using technical tools to assess whether the sector’s strength—or certain stocks within it—might offer a potential opportunity.

Those were Monday’s strongest sectors. Now let’s look at the weakest sectors in the market.

FIGURE 4. MARKETCARPETS CHART OF THE UTILITIES SECTOR. The sector was dragged down by its largest stocks.Image source: StockCharts.com. For educational purposes.

The regulatory ruling that impacted Constellation Energy Corp. (CEG), causing a 12.46% drop, pulled down the entire Utilities sector. Public Service Enterprise (PEG) faced the next biggest loss, falling 6.23%. While there were a few gainers, none were particularly well-known names.

The manner of Utilities’ decline differs from the Financial sector, as you will see below.

FIGURE 5. MARKETCARPETS CHART OF THE FINANCIAL SECTOR. Bearish pretty much all the way around.Image source: StockCharts.com. For educational purposes.

While negative sentiment painted the financial sector with broad strokes, none of the biggest losers were any of the sector’s heavyweights. But again, neither were its biggest winners. This is the market expressing its pre-election jitters. Weighing the prospect of continuing inflation, whether it’s driven by tariffs or fiscal spending, there seems to be no clear path out of the price conundrum, and that’s what we’re seeing in the sector.

So, what might you do next?

How To Position Yourself During and After the Election

Here are five MarketCarpets tips.

- Identify Sector Trends Quickly. Get a fast, visual snapshot of which sectors are leading and lagging.

- Monitor Sector Performance. Focus on sectors that are sensitive to policy outcomes.

- Look for Surprising Movers. Sometimes, the largest stock movers aren’t the sector’s heavyweights, and sometimes they are. Use MarketCarpets’ display to identify these changes quickly.

- Drill Down to Industry-Specific Strengths. Zoom into individual sectors on MarketCarpets to see which industries within sectors are performing best.

- Look for Signs of Rapid Reversal. Post-election, stocks and entire sectors might overreact to news, leading to quick sell-offs or rallies. Follow the MarketCarpets to catch any quick reversals in sectors or stocks that signal re-adjustment and drill down on each stock using your preferred technical tools. You might find opportunities early on.

At the Close

MarketCarpets can be a reliable tool for making sense of post-election market chaos. It gives you a clear snapshot of sector trends, showing which areas are gaining or lagging as the market reacts to the evolving political realities. By highlighting top performers, undervalued plays, and industry-specific movers, you can spot the biggest opportunities quickly before swooping in for a deeper dive into your targets.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.